Decentralized Finance

The underlying premise of DeFi is peer-to-peer financial transactions. These are transactions between two parties without the need for a third party. In centralized finance, borrowers apply for a loan and pay service and interest fees. With peer-to-peer lending, the applicant applies for a loan and receives funds directly from the lender. This process is done in the blockchain. Once approved, the funds are transferred to the lender.

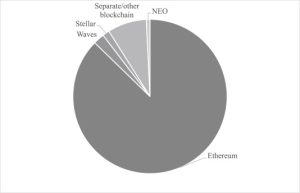

A decentralized finance ecosystem is the next evolution of the financial industry. The growth of blockchain technology has made this a natural product, and with it comes ready-made infrastructure. Since the launch of the Ethereum network in July 2015, the number of transactions has grown 33 times to 1.2 million per day. With the inclusion of additional chains, this figure would reach millions. The uptake of DeFi could increase liquidity for small and medium-sized businesses, and may even improve their competitiveness.

With the advent of blockchain technology, decentralized finance is becoming a natural product. With its ready-made infrastructure, decentralized finance news is gaining speed and popularity. Since the launch of the Ethereum network in July 2015, the number of transactions on the network has increased 33x to over 1.2 million per day. If all chains were included, the number of transactions would top millions daily. This growth will continue to be huge, and the benefits are many.

Decentralized Finance Is on the Rise

A new wave of innovative financial services has emerged. Decentralized finance is powered by blockchain technology and is designed to work with cryptocurrencies. The technology is still in its early days, and there are risks associated with it. While the benefits are clear, many questions remain about the safety of the system. Further, because of the lack of regulation, the industry remains prone to hacks, infrastructure mishaps, and scams.

A major advantage of this new technology is its ability to create a decentralized ecosystem that allows for a diversified set of financial services. Its unique infrastructure allows anyone to start a business on the platform and take advantage of its openness. Its open nature has the potential to improve liquidity and financial services for SMEs. But the question remains: what regulations can be implemented to ensure that decentralized finance is safe?

The concept of decentralized finance is a hot topic today. It’s an emerging ecosystem of new financial services. It is based on blockchain technology and programmable capabilities. The protocol allows people to build businesses on top of its infrastructure. For example, Aave is an open source network. Aave is a decentralized protocol that allows for global trading of digital assets. This is a breakthrough technology that is revolutionizing the financial industry and the entire global economy.